After years of strength during the pandemic, travel suppliers and sellers say that Mexico bookings softened this year as U.S. travel demand moved to long-haul destinations and cruises.

While the slump raised questions about whether there is some fatigue with the sun-and-sand staple that was so popular during the height of the pandemic, advisors and operators expressed confidence that the dip will be short lived and that Mexico will be back in 2024.

“Mexico’s fatigued,” said Jack Richards, CEO of Pleasant Holidays, who said Mexico bookings are down double-digits this year. “From 2020 to 2021, during the pandemic, it was one of the few countries open for travel. People have been there, and they decided to go somewhere else in 2023. But it’s not that concerning at this point for 2024. We’ll be fine.”

Hyatt Hotels Corp. CEO Mark Hoplamazian said earlier this month that the company’s Apple Leisure Group (ALG) arm saw more “temperate” Cancun demand in the third quarter, as the destination reverted to more regular seasonal patterns after being a “go-to market” for much of the pandemic.

This was echoed at ALG Vacations’ annual ALG Ascend conference in Cancun in late October, where suppliers including ALG, whose core destination market is Mexico, said the return of long-haul international travel and cruising took share from Mexico vacations last year.

“It presented a whole new set of competition,” said Ray Snisky, group president of ALG Vacations. “If I look at Europe and cruising, which were shut down earlier on [during the pandemic], there’s a lag; they are where we were a year ago. There’s big pent-up demand for those destinations and products.”

Even the nearby Caribbean took some Mexico demand this year, some advisors say, with travelers looking for other short-haul beach vacations and finding plenty of options in the region’s variety of islands.

“I feel travelers are more interested in other destinations,” said Ashley Taylor, a North Carolina-based advisor with Key to the World Travel. “People are exploring other destinations in the Caribbean. My European market has picked up tremendously and so has the South Pacific and Asian markets, [where] demand is 25% higher than last year.”

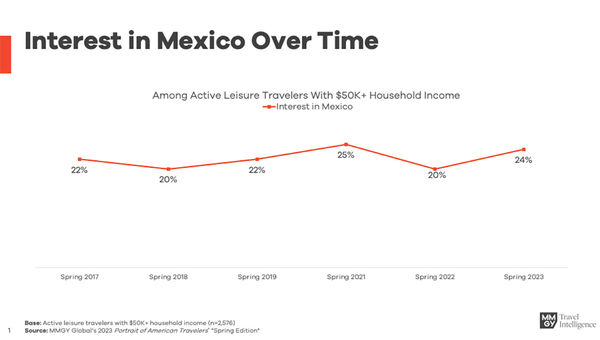

Clayton Reid, executive chairman of marketing firm MMGY Global, said MMGY data showed a decrease in Mexico travel interest in 2022, dropping to 20% among active leisure travelers, a five-point decrease from 2021, when interest was at its peak.

“There has been some softness,” Reid said of Mexico travel this year. “It was really, really high during Covid, and that demand moved to long-haul international — think of Europe, for example.”

Reid said he believes that trend will reverse in 2024 when many of those long-haul travelers return to the short-haul market. The MMGY study shows that Mexico travel interest bounced back to 24% among leisure travelers when surveyed this year.

Hoplamazian also noted several bright spots for ALG’s Cancun business, citing “tremendously strong” holiday demand, up 8% for ALG luxury all-inclusives in Cancun, and the booking pace for the first quarter of 2024, up 12%.

Snisky is confident the Mexico exodus is temporary, saying travelers will be drawn to Mexico’s value proposition, but that the upscale market will also be lured back by continued investment.

“The quality of product continues to get better and better here,” Snisky said, pointing to the Impression Moxche and the Impression Isla Mujeres by Secrets, the two newest luxury all-inclusive resorts to join ALG parent company Hyatt’s portfolio. “There are world-class level resorts being built in this destination and we’re going to continue to raise the bar of the Cancun experience.”

Investments in Mexico’s luxury hotel and all-inclusive space since the pandemic also include the Grand Velas Boutique and St. Regis in Los Cabos.

And as more flights open in 2024 to destinations including Mexico City and Guadalajara, travelers will have more options to choose from.

“Mexico demand is widening beyond Cancun and Riviera Maya,” said John Hawks, executive director of the Destination Wedding & Honeymoon Specialists Association, citing Puerto Vallarta and Merida. “There are more upscale and true luxury properties than there has been in the last 10 years. There are people who want the luxury experience but don’t want to fly to Europe to get it.”

Mexico hasn’t softened for every seller

Not all suppliers and advisors experienced a drop in Mexico bookings this year. Some even said demand increased.

Travel advisors attribute Mexico’s popularity to the higher flight costs to Europe and the Caribbean but mostly to the overall value travelers find in Mexico.

“I am actually seeing the opposite: a huge influx to Mexico,” said Alisa Cohen, founder of Luxe Traveler Club in Washington, D.C. “Based largely on the increasing costs of flights, Mexico still seems to price better than the Caribbean on air, and the fact that the quality of the hotels and service in Mexico are fantastic.”

Jennifer Doncsecz, president of VIP Vacations in Bethlehem, Pa., whose bookings to Mexico have grown year-over-year since 2021, said most clients ask about other destinations but ultimately see the savings for Mexico.

“Overall, flight costs are really the culprit when it comes to demand,” Doncsecz said. “For our clients, other destinations — Jamaica, Punta Cana, St. Lucia, Antigua, Barbados and Aruba — seem to be pricing much higher for flights, but Mexico has been really steady, and with so much hotel inventory, we can easily put a package together that is much less expensive than most of the sun/fun places in the Caribbean.”

Johanna Jainchill and Christina Jelski contributed to this report.